The industrial sector has always been a driver of progress, but it is also one of the largest contributors to environmental challenges. As the world looks towards a more sustainable future, industries face growing pressure to reduce their impact on the planet while continuing to deliver growth and innovation.

Technology is proving to be the bridge between these two demands. From cutting carbon emissions to reducing waste and conserving resources, cutting-edge solutions are enabling industries to operate more responsibly while maintaining productivity and competitiveness.

Smarter Energy and Resource Management

Energy efficiency is at the heart of sustainable operations. Technologies such as advanced monitoring systems and AI-powered analytics allow companies to track energy use in real time, highlight inefficiencies, and make adjustments that reduce both costs and carbon emissions. Similarly, water and resource management tools are helping businesses optimise consumption, ensuring that valuable resources are used efficiently and waste is kept to a minimum.

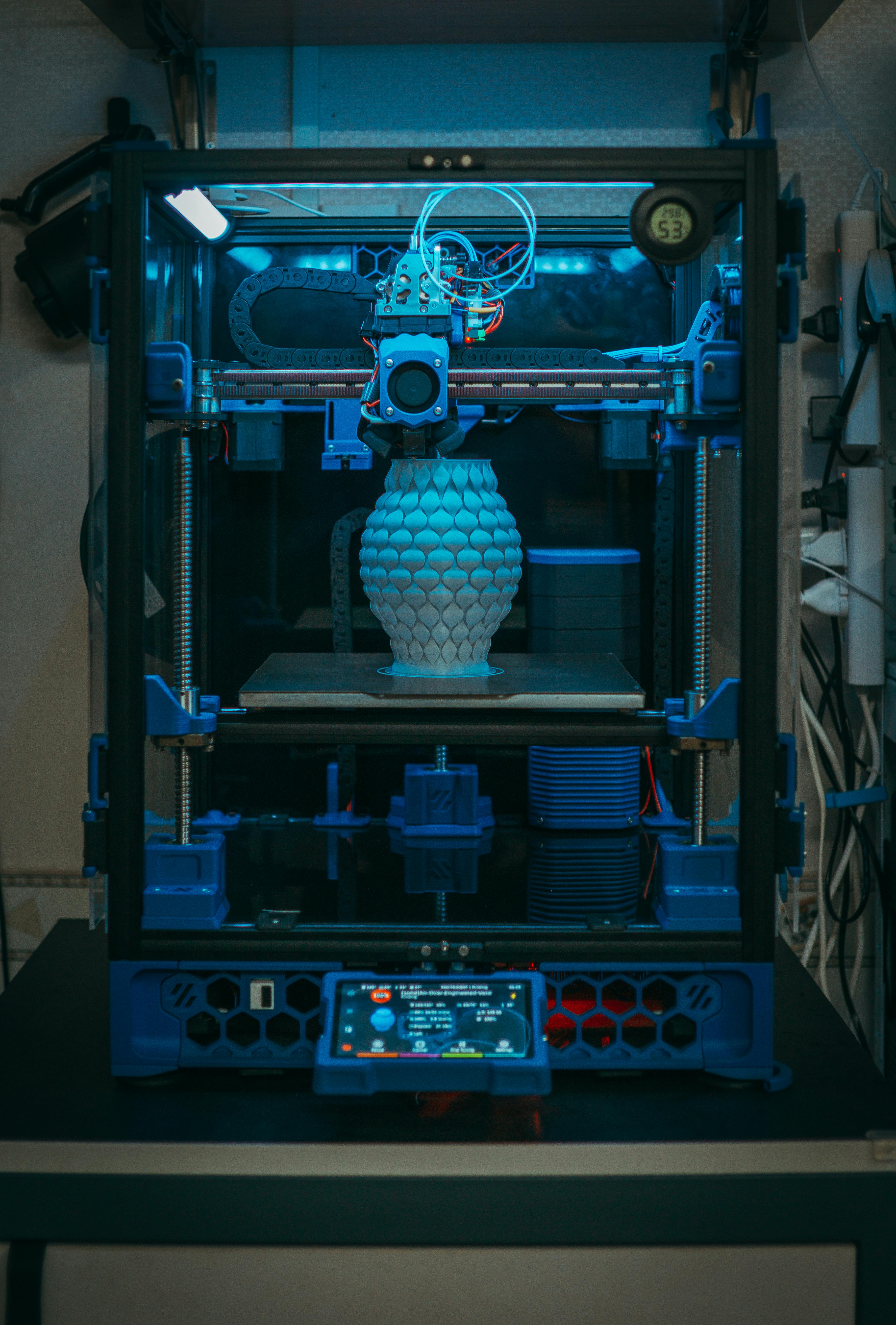

Cleaner Production Methods

Manufacturing has traditionally been resource-intensive, but innovation is making it possible to reduce environmental impact without sacrificing quality. Automation, robotics, and additive manufacturing are cutting down on waste while improving consistency and speed. These technologies are enabling businesses to adopt leaner, cleaner methods of production that align with sustainability goals and regulatory requirements.

Tackling Industrial Waste

One of the most significant environmental challenges for industry is dealing with waste – particularly in sectors such as pharmaceuticals, petrochemicals, and food processing. Traditional waste management approaches are no longer enough to meet modern standards for sustainability and compliance.

This is where advanced Industrial Wastewater Treatment Solutions are making a real difference. By removing harmful contaminants and reducing the toxicity of wastewater, these technologies prevent pollution and help businesses meet strict environmental regulations. At the same time, they demonstrate a genuine commitment to protecting natural ecosystems and the communities around industrial sites.

Digitalisation and Predictive Insights

The rise of Industry 4.0 has given businesses powerful digital tools for sustainability. Machine learning, artificial intelligence, and data analytics provide predictive insights that help companies plan smarter, reduce resource use, and avoid downtime caused by equipment failures. With these technologies, sustainability becomes integrated into everyday processes rather than treated as an afterthought.

Supporting the Circular Economy

Technology is also enabling industries to participate in the circular economy by reclaiming materials, reusing resources, and designing systems that minimise waste. Advanced recycling methods and closed-loop systems are helping businesses reduce their reliance on raw materials while lowering their environmental footprint.

Building a sustainable future for industry is one of the greatest challenges of our time – but it is also an opportunity for innovation. By embracing technologies that support energy efficiency, cleaner production, advanced Industrial Wastewater Treatment Solutions, and circular economy principles, industries can reduce their impact while staying competitive.

Sustainability is no longer just about compliance; it is about resilience, reputation, and long-term success. The businesses that act now will not only meet today’s demands but also lead the way towards a greener industrial future.